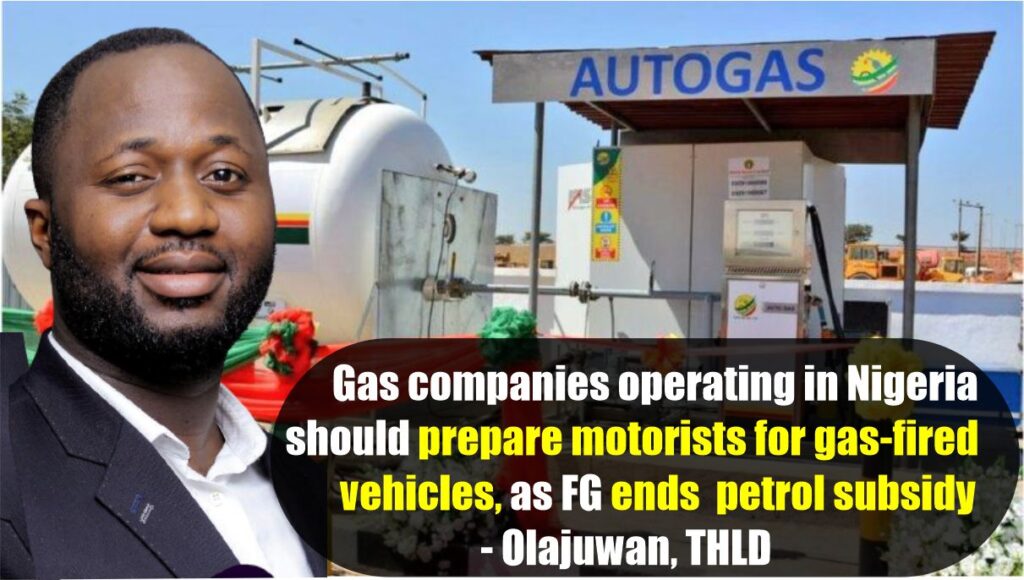

Gas companies operating in Nigeria should prepare motorists for gas-fired vehicles, as FG ends petrol subsidy- Olajuwan

Oredola Adeola

Gas companies operating in Nigeria have been charged to take up the responsibility of preparing Nigerian motorists for AutoGas (LPG and CNG) low-emissions fuel that is cheaper and cleaner than the conventional petroleum-based transport fuels – Premium Motor Spirit (PMS) and diesel- in the face of imminent removal of petrol subsidy in Nigeria.

Oluwasegun Olajuwan, Group Managing Director at THLD Group, an International Logistics Ltd with a special focus on LPG / CNG trucks, made this call in a statement obtained by EnergyDay on Thursday.

He made this call as one of the strategic measures that must be taken to ease the enormity of the challenges and associated legacy problems that would greet the removal of the subsidy.

According to him, how ready are we in Nigeria to adopt gas as an alternative fuel? Why are gas companies not building gas stations across the country?

He said, “We can all agree now that GAS will be playing a very significant role in the imminent removal of subsidy in Nigeria.

“With the news of the $800 million World Bank grant, we can all say subsidy is going and we must now start asking ourselves that question what, how, when will gas stand up to the big task ahead to provide motorists in Nigeria with a cheaper alternative fuel.

“The number one question is why are the current gas companies not building stations? Why are they ignoring the cheapest infrastructural investment in the gas supply chain and focusing on the most expensive ones?

“Why are they ignoring the ONE product that guarantees more volume in the entire supply chain and focusing on the more complicated products that use LPG and CNG?

“Why are GAS companies waiting on government, and why are gas companies refusing to understand that the current situation surrounding diesel is enough reason to invest massively in gas and with quicker returns on investment?

Olajuwan however revealed that Egypt built over 500 CNG stations in less than two years, adding that the North African country also converted over 60,000 vehicles to run on GAS in the same period.

He noted that the Egyptian government made the investment. He also revealed that private sector participation was seen as vehicles were made available and conversions were done with ease.

“Gas companies must stand up and work up to ensure that gas doesn’t fail our economy. We must stop gas flaring; we must start using gas not just to its maximum, but as an alternative and special transitional fuel.

The GMD of THLD Group, however, encouraged all the major players in the gas value chain to come together and charter a course for the industry.

Olajuwan also added that critical stakeholders, the regulatory authorities, and government agencies must all come together to deliver the Decade of Gas and much touted Nigeria’s gas-based economy.

EnergyDay’s check showed the autogas policy of the Nigerian Government to ensure that vehicles plying the country’s roads run on Compressed Natural Gas (CNG) as an alternative to Premium Motor Spirit (PMS) had suffered set back due to lack of commitment.

Outgoing Nigeria’s President Muhammadu Buhari promised to convert one million vehicles plying the country’s roads to autogas within a year, although this has been reviewed for three years with limited success, since 2020.

EnergyDay gathered that the Government proposed about 200,000, 300,000, and 500,000 be converted in the first, second, and third year respectively or 500,000 vehicles would be converted in about 18 months and the other 500,000 within 19 to 36 months.

In the period, 200,000 tricycles were projected to be converted, 610,000 four to six-cylinder engines, 100,000 eight-cylinder SUVs, and 100,000 buses.

Timipre Sylva, Nigeria’s former Minister of State for Petroleum Resources, last year revealed that CNG holds a comparative advantage due to its ease of deployment, adding that the commodity offers comparatively lower capital requirements, commodity’s supply stability, existing in-country volumes, and local market commercial structure which relies predominantly on the Naira.