Petrol subsidy removal: Marketers turn to Russia, Middle East, leaving Europe refineries in DUST

Petrol exports from northwestern Europe to Nigeria and other West African countries

Oredola Adeola

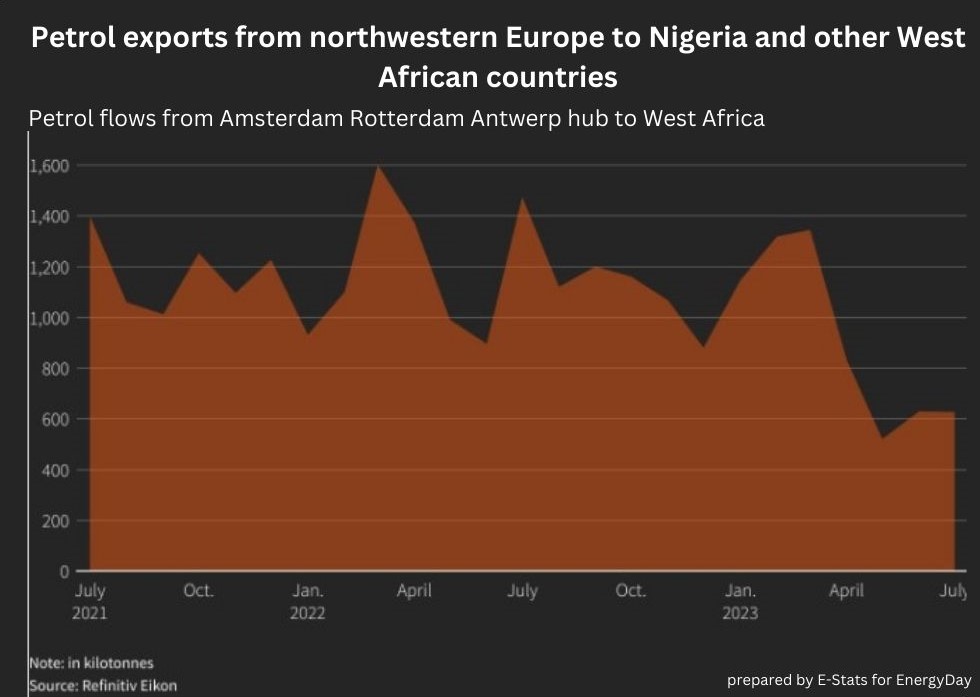

Nigeria’s demand for Europe-refined Premium Motor Spirit (Petrol) has declined following 56% drop in average monthly West African (WAF) petrol importation due to the removal of subsidy by the country, which is the major importer from West Africa, data from Refinitiv Eikon showed.

An analysis of the data on product importation, based on Refinitiv Eikon data showed that loading of product by West Africa(majorly Nigeria) from the Amsterdam-Rotterdam Antwerp(APA) refineries fell to 874 million (629,000 tonnes) in 2023 from 1.2billion litres (895,000 tonnes) in 2022 and 1.628 trillion liters in 2021.

1,600,000,000,000

Loading for July, 2023, fell from 874 million litres which was the figure for the first six months of years to 870 million litres (627,000 tonnes).

According to Raj Rajendran, Refinitiv Lead Oil Analyst, the key point is that demand from Nigeria( major importer from West Africa) is drying up.

Refinitiv Eikon data, showed that an increase in Russian petrol direct flows into Nigeria started in January, growing from virtually non-existent in recent years to around 800,000 tonnes year-to-date, are still small.

Rajendran said, “It’s not like (Russia is) capturing a bigger share of that market from European refiners. The challenge is coming from the new refineries in the Middle East that are expanding from their traditional East Africa market to now include West Africa and beyond even to the Americas.”

Philip Jones-Lux, Sparta Commodities gasoline market analyst, in his observations of the market, also said that “Demand for barrels into WAF may be lower at the moment as the market sorts itself out again post-subsidies. There may simply be a baseline decrease in demand.

Jone-Lux emphasised that it is cheaper for new Nigerian oil marketers to import from the Mideast Gulf and Russia than from Europe.

“The volumes appear small still, but not insignificant,” he said.

He disclosed that petrol importation from the Mideast Gulf is around $35-$50 per tonne cheaper than refined products from ARA, which means that the bulk of the imported product into the West African region will come from the Middle Eastern.

Available data also showed that the first three months of 2023, both Nigeria and Ghana upped their intake of Russian motor gasoline from 0 kb/d in 2021 to an average of 43 kb/d and 6 kb/d respectively.

Experts attributed the significant fall in the volume of product imported from Europe majorly to the depreciation of the Naira, which happened based on the decision of the Central bank to allow the Naira to drop as much as 36% on the official market, leading to a record low exchange rate of 750 Naira to the dollar.

Imports, however, are increasingly unaffordable as Nigeria’s naira has weakened to record lows since the central bank removed currency restrictions in June. At the same time, inflation is near two-decade highs.

Emadeb Energy Services Ltd., Eterna Plc, and Asharami Energy, the first set of marketers to import petrol into Nigeria in July, 2023 have all complained about the cost of forex for importation of the product.

Mr Debo Olujimi, Emadeb Energy Service, Chief Executive Officer, during the inauguration of the first petrol cargo by Emedab Energy at its Ijegun Satellite Depot in Lagos in July 19, said that it incurred a cost of over 17 million dollars due to foreign exchange rates at the international market to take delivery of 27 million litres of petrol.

Another major reason for the decline in importation is also linked to the drop in domestic demand for petrol as motorists have reduced their consumption due to the hike in fuel price from about N200 to between 580 to around N680 in parts of the country.

The significant drop in the regional market for smuggled subsided petrol from Nigeria played another major role in the decline in expensive fuel from Europe.

EnergyDay gathered since President Bola Tinubu announced the end of Nigeria’s fuel subsidy in May 2023, the fuel market in most of the West African countries including Cameroon, Togo, Rep of Benin and Niger relied majorly on smuggled petrol from Nigeria collapsed completely.

Report showed that prices of black-market fuel doubled in neighboring countries, black market fuel vendors and commercial drivers who were heavily reliant on petrol smuggled from Nigeria have seen their businesses collapse.

Available data from both official and independent sources showed that about 22.27 million litres, which is equivalent to one-third of 66.8 million litres of average daily petrol consumption in Nigeria.

According to the data from the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) in June 2023, the average daily petrol consumption in Nigeria was 48.43 million litres, down from the previous average of 66.9 million litres.

The importation of petroleum products in Nigeria is expected to decrease when the Dangote Refinery starts operating later this year.

Additionally, President Tinubu is putting pressure on the rehabilitation of the three refineries in Port Harcourt, Warri, and Kaduna.

There are also prospects of refining capacity from other private refineries across Nigeria, including modular refineries, some of which are producing marginally.

Advertisements